Recipe of the Month

Posted on November 17th, 2023

RING OF FIRE

Posted on October 6th, 2023

Business Spotlight

Posted on September 11th, 2023

Recipe of the Month

Posted on September 11th, 2023

Claim Corner

Posted on September 11th, 2023

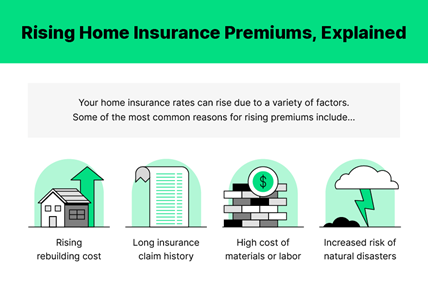

Can we talk about the elephant in the room?

Posted on September 11th, 2023

Business Spotlight

Posted on August 7th, 2023

Recipe of the Month

Posted on August 7th, 2023

DO YOUR KIDS HAVE GOOD GRADES?

Posted on August 7th, 2023

Calling all College Students

Posted on August 7th, 2023