Can we talk about the elephant in the room?

By Amy Streifel

I hear it at coffee talk. I hear it at social settings. I hear it at work. The scandal that has everyone talking….that’s right people, I'm talking about insurance rates. You about have to live under a rock to have not noticed or heard about insurance rate increases. I'm here to put your mind at ease and clear up any rumors. The worst thing you can do is misunderstand your own insurance rates by something you have heard. And PLEASE, do not compare your neighbors insurance to your own. Every policy is specialized to fit YOU. So when I hear the phase "my neighbor said", I cringe. Talk to your knowledgeable agent if you have questions on your insurance, not your neighbor. So, what's the deal with rates? It’s not all cut and dry. I review all of my clients rate increases and have to make those call on a daily basis. I wish I had the exact answer for each person, but everyone is different. There are a lot of variables that go into determining rates. Some of the factors are the carrier’s filed rates, where you live, your age, your insurance score and more. As for the rise in insurance rates across the board, a couple main reasons; car repair costs have soared and major labor shortages. Factories and trade routes are still struggling from the effects of the Covid Pandemic.

As you review your home and auto policies during the remainder of 2023, here are a few recent statistics to keep in mind:

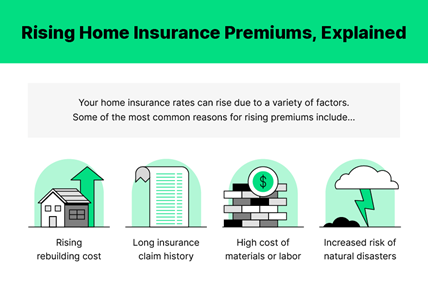

Homeowners insurance rates continue to rise. Since 2015, the average homeowner has seen their bill for insurance rise by approximately 21% - and as much as 57% in natural disaster-prone states like Texas and Florida. The culprits? Climate change, insurance fraud, and inflation. Most experts anticipate a 9% increase this year - roughly $150 per annual policy.

Auto insurance rates climbed nearly 15% in some states over the past year, rising more than $240 on average nationwide to $2,014 per year. What’s more? Approximately 11% of drivers now pay more for their car insurance than for their car payments.

· Mitigate the increase in premiums by taking advantage of new discounts, asking your agent about telematics programs, improving your credit, and increasing policy deductibles.

NuLine is here to help! We are always very informed with the current industry trends. Remember, one of the benefits of working with us is that we have access to multiple insurance carriers and can shop around to get you the best rates!